Moore Financial Solutions 2nd Quarter 2025

The stock market carousel continued in the second quarter of 2025, with some investors jumping off, while others jumped aboard. Aiming for a solid return to follow a negative 4.59% Q1, the S&P 500 slated a 10.57% return for our second quarter (1). During this most recent quarter, I leaned on my beliefs mentioned fifteen months ago in my Q1 2024 Moore Financial Solutions review; “we feel that investors unknowingly become more faithful in broad U.S. equities to recover after a downturn.” In that previous review I offered a thought that investors have become more trusting that markets will recover after seeing it happen in the 29 historical bear markets, as compared to the first ever bear market, for example. Though my continued theory is that the average bear market duration will decrease over time (with younger investors portfolio managing more assets and algorithmic trading increasing), even I was surprised by the minor 83-day bear market speed bump that the S&P 500 shook off, given that prior to this the average bear market was 289 days (2). The S&P 500 would go on to close Q2 both positive for the year and at record highs. In this quarterly review we’ll look at how bear markets are rarely the same and how our strategy must evolve. We’ll discuss a stubbornly high interest rate, our positioning for potential interest rate decreases, and global matters affecting the market.

It’s been said for years that the stock market takes the escalator up and the elevator down. But why? Simply put, this is the result of the driving forces of selling and buying stocks. If investors are optimistic, they’ll commonly allocate to the stock market in an attempt to grow their money. But too much of this buying is deemed greedy and is a great evil of long-term investing. If investors, however, are fearful, they’ll sell their stocks, (at least the less emotionally committed, shorter term investors), driving the price of stocks lower. We believe Q2 is a great example of the battle between fear and greed, and the only real concern is being wrong on predicting short-term market movements. Over the first six trading days of Q2, investors sharply drove the S&P 500 about 11.2% lower, with panic fueled by President Donald Trump’s April 2nd liberation day announcements (3). A resilient S&P 500 would heal the 11.2% wound in only 17 trading days, leaving behind investors who may have been scared out of the market near April 8th closing lows on the S&P 500 of 4,982.77 (4). This would be the first and only closing price below 5,000 on the S&P 500 from April 20th, 2024, to today’s July 1st, 2025, date. In our opinion, this supports our thoughts regarding algorithmic trading, which likely conducted heavy buying at levels of support below 5,000. April 9th would serve as the third largest one-day gain for the S&P 500 in history, increasing by about 9.5% (5). We view the sudden announcements and emotional reactions in the stock market as a great reason to stay the course in our investments. By staying focused on our long-term perspective, while short-term winners and losers argue over the current price, we’ll be less likely to panic and instead willing to accept an average return, rather than attempt to outsmart the market. Moore F.S. was able to capitalize in some situations by selling bonds and buying stocks, when appropriate. While it is not fully determined who lost what, it is implied that a portion of investors locked in losses in Q2, by panic selling with the herd mentality near April 8th lows. These investors would, as a result, miss out on what would become a fruitful Q2 for those willing to wait the required 84 days and not be emotionally rattled.

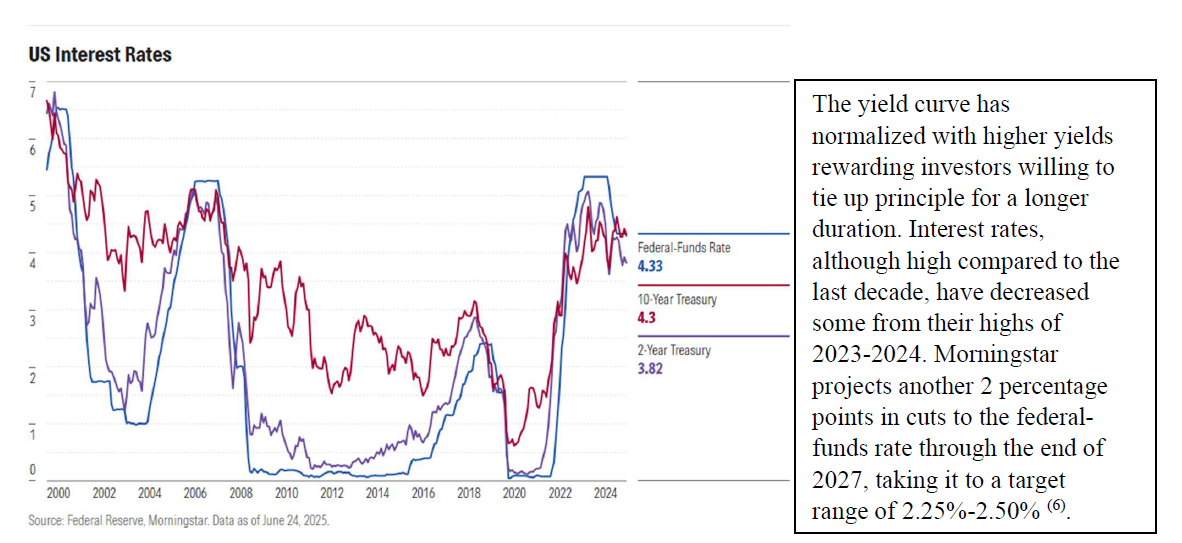

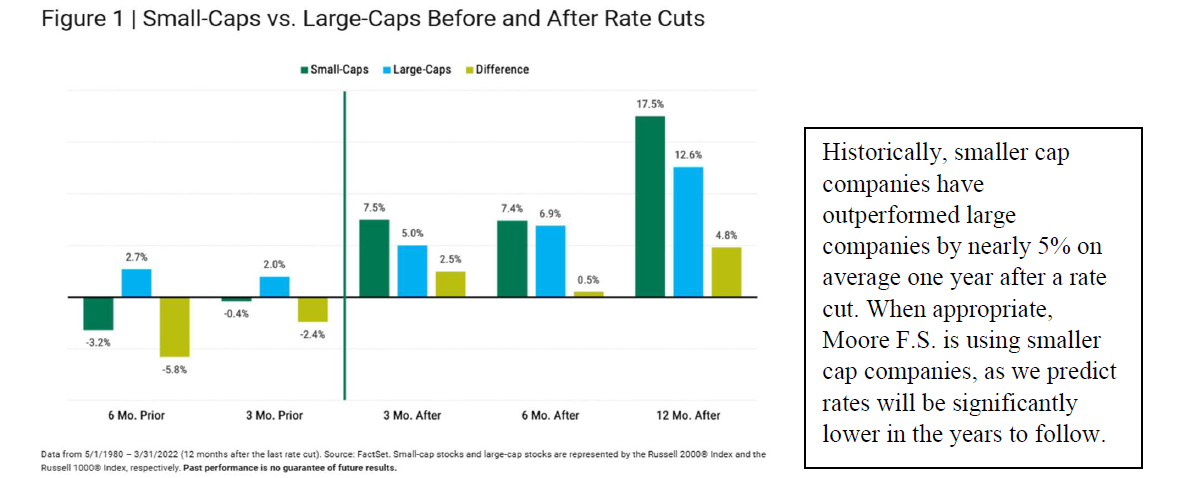

A tug-of-war has ensued between President Trump and Federal Reserve Chair Jerome Powell. As chair Powell is tasked with threading the needle with his interest rate decrease timing strategy. President Trump has openly encouraged chair Powell to move more quickly on interest rate cuts in hopes of easing consumer budgets and helping federal debt costs. The extreme difficulty for Powell, as mentioned in our past reviews, lies in his attempt to ensure that inflation expectations get back to his two percent goal, which has been made more difficult with tariffs. However, he must not keep rates elevated too long, potentially harming economic growth. Moore F.S. remains under the expectation that the Federal Reserve has at least one percent of cuts coming within the next year and has uniquely positioned portfolios for this occurrence. We anticipate investors being able to capitalize on a decreasing interest rate for varying reasons. Investors closer to their goal or in retirement may hold bond funds that will appreciate from interest rate decreases. For these investors, Moore F.S. has specifically chosen to primarily hold long duration bond funds, which stand to benefit greater from interest rate decreases. For all investors, even those that do not hold bond funds (bonds historically may be too conservative for long term investors), we’ve generally increased the weighting of small/mid cap companies in names such as iShares Core S&P Small Cap ETF (ticker symbol IJR), iShares S&P Mid-Cap 400 Value ETF (IJJ), iShares S&P Mid-Cap 400 Growth ETF (IJK). A strategy that increases weightings of positions rather than full sell or buy orders.

Zooming out to global matters we highlight the June 22nd, 2025, operation Midnight Hammer which targeted Iranian nuclear facilities Fordo, Natanz and Isfahan. Regarding the effectiveness of the damage, “several key Iranian nuclear facilities were destroyed and would have to be rebuilt over the course of years,” CIA Director John Ratcliffe said (7). When trading next occurred on June 23rd, 2025, the S&P 500 rose about one percent for the day (8). WTI Crude oil dropped 7.2% vs the prior Friday closing price (9) . In the opinion of Moore F.S. these reactions were a relief trade from a situation that could have been far worse. While we do not see this as the best-case scenario, we think it was far from a worst-case scenario. Additionally, President Trump has made very clear that our strikes will continue if Iran is unwilling to make a deal regarding their nuclear program or if they make a deal and do not honor it. As markets have been known to “climb a wall of worry” it seems the market has climbed past the Iran worry momentarily as the S&P 500 would go on to close Q2 about 4% higher after the strikes by the United States on Iran.

“Death and taxes,” the humorous way we describe uncomfortable things you can count on. Sadly, I’m here to add to your list, rough patches in the stock market. You might as well save yourself the future discomfort by just adding it to your list now. The stock market is going to have terrible moments, it is inevitable. Although I’m celebrating my thirteenth year of passionately managing money, organizing assets for clients, and helping to control human emotions, I’m far more proud that Moore F.S. celebrates its fifth anniversary this year. In those short five years I’ve managed portfolios through Covid-19, the great inflationary spike and interest rate increases that would follow, and now this most recent bear market of 2025. No two downturns are the same, so the recovery strategy can vary greatly and seem unclear. I want to thank you for your tremendous confidence in me and my abilities to manage you through any market cycle. With no statistical data to back it up, I believe Moore F.S. clients must be some of the best in the area at understanding that the market might just go down three times faster than it increases and recognizing that the normal human emotion of panic/fear may come over you at times but not letting it get the better of your actions. The good news is that I believe, in solely my own opinion, that a bear market’s average duration will continue to decrease as Q2 offers yet another suggestion to ride the market movements as an investor, rather than timing the market and introducing lucky/unlucky gamblers. I wish you and your families a healthy and prosperous Summer and hope your investments perform well. It is with great pride to be just a phone call away and always willing to talk about any of your financial strategies or questions you may have. Moore F.S. seeks to serve our clients beyond just the account in which we provide financial management.

Did you know? Moore Financial Solutions offers unique/custom-built insurance solutions. Does anything keep you up at night that we could help fix? If so give us a call and we’ll help find you the best policy rates and options as we shop the open market of providers, all while offering our zero-pressure sales process. This includes Life Insurance, Disability Income Insurance, and Long-Term Care Insurance. Let’s review your policy and search for Moore Solutions today!

1. https://finance.yahoo.com/quote/%5EGSPC/history/

3. https://finance.yahoo.com/quote/%5EGSPC/history/

4. https://finance.yahoo.com/quote/%5EGSPC/history/

5. https://finance.yahoo.com/quote/%5EGSPC/history/

6. https://www.morningstar.com/markets/when-will-fed-start-cutting-interest-rates

8. https://finance.yahoo.com/quote/%5EGSPC/history/

9. https://oilprice.com/oil-price-charts/

This material has been prepared for information and educational purposes and should not be construed as a solicitation for the purchase or sale of any investment. The content is developed from sources believed to be reliable. This information is not intended to be investment, legal or tax advice. Investing involves risk, including the loss of principal. No investment strategy can guarantee a profit or protect against loss in a

period of declining values. Past performance may not be used to predict future results. Investment advisory services offered by duly registered

individuals on behalf of CreativeOne Wealth, LLC a Registered Investment Adviser. CreativeOne Wealth, LLC and Moore Financial Solutions

are unaffiliated entities. Licensed Insurance Professional. Insurance product guarantees are backed by the financial strength and claims-paying

ability of the issuing company.