Moore Financial Solutions 4th Quarter 2024

It is with great pleasure to work as your trusted advisor for another year! We hope you and your family had a Merry Christmas and you’re headed into a Happy New Year. To the surprise of some other financial firms, the stock market created sizable gains in 2024 with the S&P 500 increasing 23.3%, ironically within 1% of the year prior’s 24.23%. Additionally, that same market index returned a modest 2.06% in the fourth quarter of 2024, with all figures mentioned not including dividends (1). With Q4 of 2024 hosting one of the biggest elections of our lives, at least as described by some, we plan to discuss how our money management strategy evolves. We proudly stayed true to our strategy and didn’t decrease our allocation to stocks, while many other firms were selling covered calls and reducing their allocation to stocks as they incorrectly predicted a downturn in the markets for 2024.

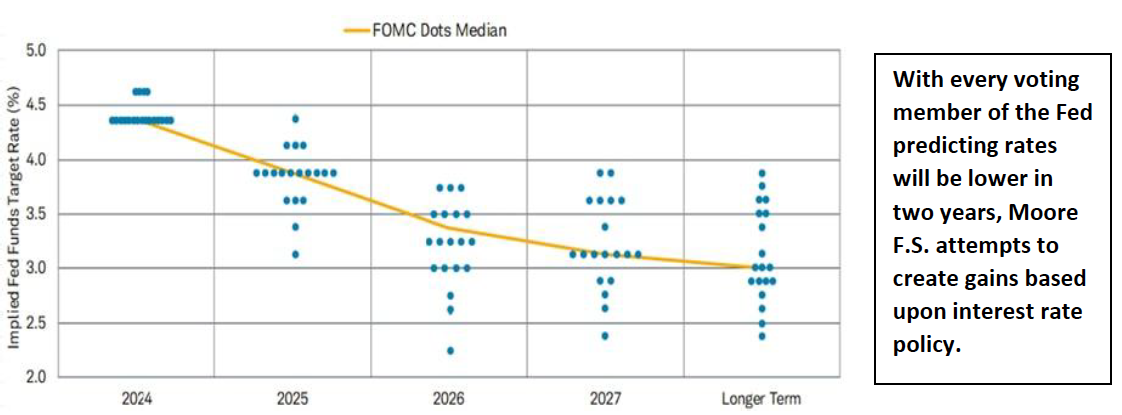

Even if you were living under a rock, you were likely informed that Donald Trump is headed back to the White House. We reference this change with the understanding that the leadership of current President Joe Biden is quite contrasting to the leadership we’ve seen from Donald Trump in the past, and his campaign promises. The Federal Reserve seemed to have had to slightly adjust their projected pace of rate cuts with the understanding that Trump will be more favorable to the economy through deregulation, corporate tax cuts, and repatriation of jobs. These factors, along with the deportation initiatives, may reignite inflation in the short term. The Center for American Progress puts the undocumented immigrant population in the United States at around 11.3 million, with 7 million of them working (2). To make matters worse, many of these jobs are considered “difficult to fill” and/or “less desirable jobs”. We believe the Federal Reserve felt the need to signal plans to slow rate reductions, after reducing rates in 2024. In September, the median projection for the end of 2025 implied four more rate cuts next year, but the median projection from December’s meeting only projects two more cuts (3). Below is the Federal Reserve’s dot plot, which is a chart that visually represents each member of the Federal Reserve's policymaking committee's projection for where they expect the federal funds rate (the benchmark interest rate) to be over the next few years.

In our efforts to monetize the movements of interest rates, and more importantly monitor the risk/reward of your portfolio, we made major adjustments to our fixed income holdings in Q4 2024. As a reminder, a significant percentage of fixed income is typically not to be held by clients with a long-time horizon. Fixed income generally offers an inverse relationship with stocks, giving a client the ability to diversify their positions and offer rebalancing strategies in years in which the broad stock market retracts, so we feel very strongly that clients closer in time to their goal should own at least some fixed income. Near the end of the 3rd quarter, it seemed everyone was convinced that interest rates had to go lower, but we remained doubtful that the Federal Reserve had accomplished their goal of getting inflation to 2%. In reaction to a sticky inflationary environment, but with falling rates in the bond market, we took the stance that rates would creep back up. Within the last couple of weeks of Q3 we sold about $900,000 worth of our iShares 20+ Year Treasury Bond ETF (ticker TLT) as we felt the bond market had gotten ahead of the Federal Reserve. We received approximately $98.95/share when sold at approximately September 20th, 2024. Knowing the importance of bonds, we decided to invest these proceeds in iShares Short Duration Bond Active ETF (ticker NEAR). Though both bond funds would continue to lose price, as bonds would naturally do when interest rates increase, the NEAR lost only about 1.5% while we avoided losses in the TLT of 11.2% (5). On 12/30/2024 we reversed this position, partly based upon the dot plot pictured above, which shows where the voting members of the Federal Reserve predicted interest rates will be in the future, purchasing back into the TLT at a price of $87.8399 and reaffirming our position of about $1.3 million within that ETF. Though catching a falling knife (the low point of the TLT) is never easy, and the price may go lower, we view this entry as a means to lock in the gain (actually the losses we avoided by being out of the TLT while it fell) rather than attempting to time the exact bottom. Additionally, when we moved from the TLT to the NEAR, the NEAR offered a higher yield, versus when we moved back the TLT was offering a higher yield. Our goal is to have a strong relationship with clients, centered on a strong foundation of communication to be able to make the changes that we see fit, and discuss how this impacts portfolios.

The strategy of Moore F.S. has always been to swing the bat for singles and doubles, and if home runs occur, that is a bonus. Our portfolios in 2024 included a tech and large cap stock heavy allocation, and we still believe in these positions. However, we only aim for about 90% of our allocations to be in broad ETFs and 10% in single stocks. We seek single stocks that are trading at a discount or offer what we think may be greater opportunities than the broad market. In our Q1 review in 2024 we discussed in detail some of the problems with the American food system and elected to use Natural Grocers (NGVC) in many of our portfolios. This single stock position went on to create more gains for our clients than we charged to manage portfolios in 2024, a scenario we live for. We view this as a success story of actively doing our own management, as opposed to using high-cost mutual funds to actively manage a portfolio.

As mentioned, I’m proud to be your financial advisor for another year and personally can’t wait to see what 2025 brings. That being said, how good can 2025 really be after two straight years of 20%+ returns? Although no one really knows the answer, hypothetically it could still be another 20% year, but we highly doubt that. We think the broad market will hit tough times in 2025, due to bonds offering a competitive yield close to 5% in many cases. Years ago, we felt that stocks were the only game in town, but with bonds selling at an attractive price and paying a decent dividend, stocks may become challenged. I believe the impacts of Donald Trump back in the White House will provide a similar result as he previously did, which was a red-hot stock market and economy. While you may hear in the media tariffs are bad, realistically their goal is to create a more level playing field for domestically made products against other countries who may be actively manipulating their currencies to price out domestically made goods. Moreover, in our opinion a 15% tariff doesn’t raise your costs by 15%, rather directs you to purchase domestic goods that might be 5% higher in cost with the ripple effects of buying locally more than making up for this 5% cost. I view the savings on energy costs will more than mitigate this burden. My largest worry is the debt this country is burdened with, and how that might elevate rates for a longer duration. My vow continues to be managing your account in what I believe is your very best interest, without becoming overly confident from my previous homerun hitting stocks. I’m looking forward to discussing your portfolio with you and welcome any thoughts or questions you may have regarding your goals. I believe with nearly 13 years of experience, I’m well balanced with experience and future longevity and encourage you to come to me with any suggestions of your friends and family that can benefit from working with me. Thank you for your continued trust and business and I look forward to another successful year working with your goals!

Tyler A. Moore

Did you know? Moore Financial Solutions offers unique/custom-built insurance solutions. Does anything keep you up at night that we could help fix? If so give us a call and we’ll help find you the best policy rates and options as we shop the open market of providers, all while offering our zero-pressure sales process. This includes Life Insurance, Disability Income Insurance, and Long-Term Care Insurance. Let’s review your policy and search for Moore Solutions today!

1. https://finance.yahoo.com/quote/%5EGSPC/history/

2. https://www.cnbc.com/2024/11/10/trumps-mass-deportation-plan-immigrant-workers-and-economy.html

3. https://www.schwab.com/learn/story/fomc-meeting

4. https://www.schwab.com/learn/story/fomc-meeting

5. https://www.marketwatch.com/investing/fund/tlt

This material has been prepared for information and educational purposes and should not be construed as a solicitation for the purchase or sale

of any investment. The content is developed from sources believed to be reliable. This information is not intended to be investment, legal or

tax advice. Investing involves risk, including the loss of principal. No investment strategy can guarantee a profit or protect against loss in a

period of declining values. Past performance may not be used to predict future results. Investment advisory services offered by duly registered

individuals on behalf of CreativeOne Wealth, LLC a Registered Investment Adviser. CreativeOne Wealth, LLC and Moore Financial Solutions

are unaffiliated entities. Licensed Insurance Professional. Insurance product guarantees are backed by the financial strength and claims-paying

ability of the issuing company.