Moore Financial Solutions 3rd Quarter 2025

With many asset classes moving higher in Q3 we hope you were able to take advantage within your account! I’m pleased to be able to review an S&P 500 that was able to maintain a generally upward trend since April 8th, 2025, a day that would not so ironically be the only closing price below 5,000 so far this year, an important statistic we will discuss in greater detail later. As investors weighed a decreasing rate environment in which the Federal Reserve reduced rates, and a weakening labor market, the S&P 500 logged a 7.79% increase (1). Fixed Income rallied with the Moore F.S. largest bond holding (iShares 20+ Year Treasury Bond ETF) increasing about 1.27% within Q3 (as of 09/30/25) and paying another nearly 1% dividend for the quarter (2). With stocks and bonds rallying together over the last quarter, I’ll discuss market moving events within the quarter, lay out my opinion of how investors can consider deploying capital in a highly valued market, provide trading ideas, and discuss our thoughts on why U.S. markets are priced at a premium globally.

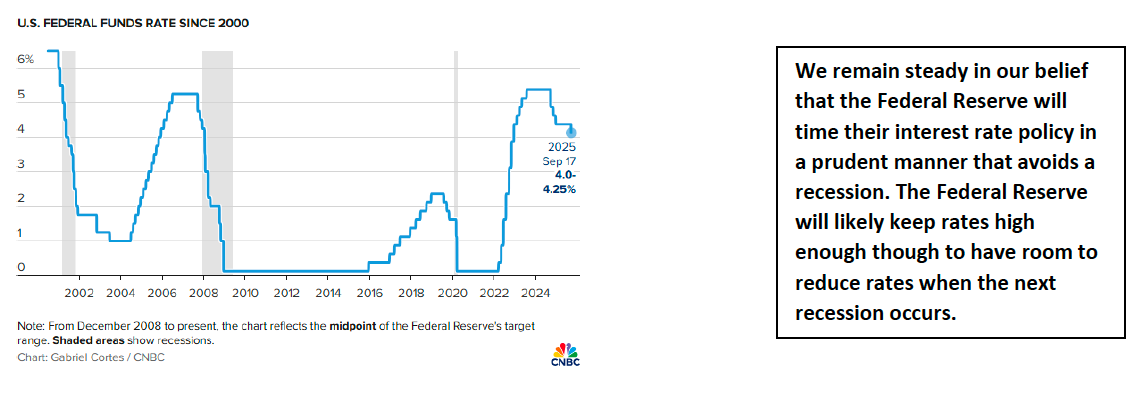

Tasked with fiduciary* management of hundreds of accounts, Moore F.S. is always strategic about your investment holdings, and attempts to strike a solid balance of risk and reward within each account. The gray-haired veteran’s account looks far different from the client born this side of the new millennium. To support this strategy, we believe that interest rate policy and trajectory can be the easiest variable to monitor regarding the decision making of portfolio construction, which Moore F.S. is proud to do “in house”, instead of using high-cost mutual funds for example. This Exchange Traded Fund oriented strategy typically results in the older client’s asset allocation being constructed of stocks and bonds strategically, and the client of the “new millennium” hosting strategy that is more related to the capitalization of stocks. In other words, in the average environment, Moore F.S. tilts younger portfolios more to small caps (using smaller companies instead of the large ones like you’ll find in the S&P 500). To oversimplify, Moore F.S. set portfolios up to help them better perform when rates fall. We feel strongly that the active management of passive ETF’s can help ensure you’ll have solid asset allocation without using actively managed mutual funds which typically lag.

Interest rate predictions remain difficult. If the consensus is that interest rates will decrease, then generally there isn’t a lot of room in this crowded trade (going with the crowd may not have nearly the same potential profit as a contrarian trade would but may be a better percent chance of being correct). However, we felt confident that the next move for rates would be lower and the inverted yield curve would normalize. One year ago, in our Q3 2024 review we stated, “We feel this temporary inversion is holding banks like Goldman Sachs back from their full potential” and added holdings of Goldman Sachs to nearly all portfolios. Moore F.S. currently holds 404 shares of Goldman Sachs, a stock that climbed from below $500/share (when we made the prediction on 10/01/2024) to $796.35/share to close this quarter (3). We feel strongly that additional Trump mandated deregulation of the banking sector leads to room to run for Goldman Sachs. We believe if you have the correct risk tolerance and time frame, you may potentially benefit from owning Goldman Sachs, developed banks with solid earnings, and the Blackrock iShares U.S. Financials ETF, if they are appropriate for your unique circumstances. We believe this actionable thought could be advantageous as a diversification away from a MAG 7 heavy index such as the S&P 500 where over 38% of the index is comprised of only 10 companies (4). Even with that in mind, we feel that the “trend is your friend” and large cap tech does still have legs to run higher, although of course we can offer no guarantees.

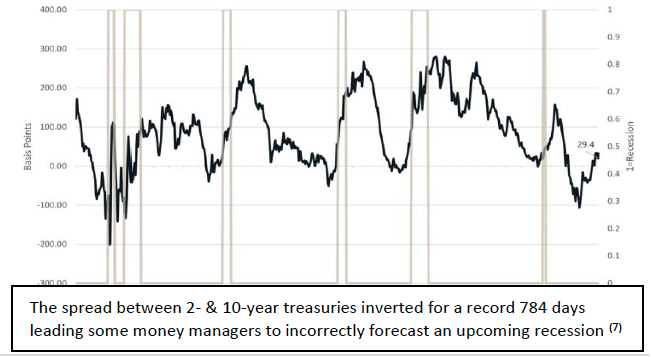

At Moore F.S. we have always taken a unique dual approach. Educate and Empower a client, as opposed to a “tough sell”. We want to always educate you on what we’re seeing, at least in our opinion. Take a moment and educate yourself on a basic function of U.S. free markets and marvel in their function and somewhat extrapolative nature. For starters, please know that “U.S. Treasuries” is a term to describe debt issued by The U.S. Department of the Treasury and allows an investor to loan the government money by purchasing treasury notes, and receive a greater sum at maturity and/or interest payments along the way. As the duration of the note increases (10-year note vs. 2-year note for example), one would assume they would receive a greater yield for waiting longer (and experiencing more inflationary erosion of their dollar). However, due to supply and demand, investors determine all these rates almost as a “vote” of the direction of the economy and in turn interest rates. As a result of these differing opinions, rates will fluctuate minute to minute. This latest quarter gave host to a further steepening yield curve between 2-year U.S. Treasuries and 10-year U.S. Treasuries. But why does Moore F.S. focus on this detail, and can it be trusted? Historically, an inverted yield curve has been viewed as an indicator of a pending economic recession. When short-term interest rates exceed long-term rates it might suggest that the long-term outlook is poor and that the yields offered by long-term fixed income will fall. Since the 1970s, a yield curve inversion has occurred before every recession. The only two inaccuracies were the 1998 and mid-2022 inversions, which produced no subsequent economic recessions. The U.S. economy did see a significant slowdown in the first half of ‘22 but rebounded in the second half (6). Moore F.S. did not employ covered call selling, cash position increases, etc. that could reduce a client’s rate of return when a recession does not occur. We felt this inversion was driven by the inflation spike that resulted from Covid-19 and rate increases mandated by the Federal Reserve to combat inflation. Alternatively, we coached clients’ emotional resilience.

For perspective, the S&P 500 has climbed over 86% since the 3,585.62 closing price 3 years ago on September 30th, 2022 (8). This steep incline has been welcomed by Moore F.S. clients and generally boosted by Covid-19 worries subsiding while Artificial Intelligence (A.I.) optimism increases. But markets do not climb at that pace forever, and we believe there will be another hard hitting down year in stocks at some point. So how can we feel good about adding new money into the stock market at these record levels? We believe it is all about time horizon and proper expectations. If you’re aiming to grow your money in a six-month period, there isn’t a stock out there we’ll recommend, rather we’d likely recommend bonds. But if you have a decade or longer, these entry points in the stock market do not create the same concern for us. Moreover, you as an investor can potentially benefit from a long time horizon and the ability to ride the next wave and let us make the necessary changes when a downturn occurs. We view this as a better strategy than doing the impossible and attempting to correctly time the market. We believe there are two broad strategies you can use for adding new money into the stock market, if that is your goal. Dollar cost averaging(1) money into various funds or stocks over a defined time can help decrease the timing risk of new money going into the market. Secondly, using exchange-traded funds that offer a value (instead of a growth) strategy might ease the timing risk of these purchases. Ultimately, we believe with greater emotional resilience investors will need to rely less on these strategies and focus more on a buy and hold strategy.

With a metaphorical mountain climb over the last three years, we can feel proud. Proud that you were not emotionally rattled during the challenging and uncertain times. Proud to feel confident you’ve hired the right fiduciary. But with this climb comes great responsibility. Contrary to situations in which markets are low and we can just buy everything; we’ve become increasingly pickier with where assets are allocated. In paragraph two of our Q1 ’24 review we educated our readers about Price/Earnings ratios (P/E ratios). This measure of what investors are willing to pay today to receive future earnings speaks to perceived value and, to some degree, risk of that asset. In this previous quarterly review, we highlighted an S&P 500 that had a P/E ratio of 27.19, compared to today’s approximate P/E ratio of 30.97 (10). But are markets overvalued at 30.97 times earnings? We said in that previous quarterly review that we might not feel as comfortable if the ratio goes above 30. However, over the last year and a half, the adoption efficiencies and timeline for A.I. implementation have increased. Fully adopting artificial intelligence could save corporate America $920 billion annually net of implementation costs, according to data from Morgan Stanley (11). Suddenly a willingness to pay more today for future earnings is justified in our view and likely the result of the approximate 3-point increase in the P/E ratio of the S&P 500. By contrast, the European markets are running a 17 P/E ratio approximately (12). Thus, we believe the time will come to diversify back into the European markets, which have lagged the U.S. markets. However, the United States remains the financial epicenter of the world and the envy of the entire globe. Coupled with its robust technology footprint, we still feel that as of this quarter the premium associated with U.S. stocks is justified even if the P/E ratio is above its average levels. Moreover, in a year like 2025 when the market only closes below 5,000 for one day, it would seem that algorithmic trading may offer a level of stability and a floor to broad markets. We believe investors have better trained themselves to have proper expectations of the market’s fluctuations, especially Moore F.S. clients. Additionally, confidence has strengthened that beating the market consistently is nearly impossible, with nearly 90% of money managers failing to beat the market, we believe clients will continue to become more oriented to buy and hold and/or index their portfolio (12).

As mentioned, you should be proud of any growth you’ve seen. And I’m proud to work with you towards your goals. I want you to be emotionally prepared for markets to turn south, in case a downturn occurs, but enjoy the ride we’re on. My goal is to educate you on how I manage your money and what is happening within our economy, yet also give you extreme confidence that I’m managing everyone’s money with the same strategic intentions regardless of your knowledge level. I believe that Moore F.S. clients generally make great decisions, and a well-educated client values the duties a fiduciary is tasked with. I will continue to monitor your asset allocations based upon my research (such as the spread in yields between 2-year treasuries and 10-year treasuries that we discussed previously) and welcome any questions regarding you or your loved one’s personal financial goals, even if it is not directly related to what I’m managing. I believe together we make a great team, and I thank you for the trust you place in me to act as your fiduciary.

Did you know? Moore Financial Solutions offers unique/custom-built insurance solutions. Does anything keep you up at night that we could help fix? If so give us a call and we’ll help find you the best policy rates and options as we shop the open market of providers, all while offering our zero-pressure sales process. This includes Life Insurance, Disability Income Insurance, and Long-Term Care Insurance. Let’s review your policy and search for Moore Solutions today!

1. https://finance.yahoo.com/quote/%5EGSPC/history/

2. https://www.marketwatch.com/investing/fund/tlt

3. https://www.marketwatch.com/investing/stock/gs

4. https://www.slickcharts.com/sp500

7. https://www.chicagofed.org/publications/chicago-fed-letter/2018/404

8. https://finance.yahoo.com/quote/%5EGSPC/history/

10. https://www.multpl.com/s-p-500-pe-ratio/table/by-month

11. https://www.axios.com/2025/08/19/ai-jobs-morgan-stanley

This material has been prepared for information and educational purposes and should not be construed as a solicitation for the purchase or sale of any investment. The content is developed from sources believed to be reliable. This information is not intended to be investment, legal or tax advice. Investing involves risk, including the loss of principal. No investment strategy can guarantee a profit or protect against loss in a

period of declining values. Past performance may not be used to predict future results. Investment advisory services offered by duly registered

individuals on behalf of CreativeOne Wealth, LLC a Registered Investment Adviser. CreativeOne Wealth, LLC and Moore Financial Solutions

are unaffiliated entities. Licensed Insurance Professional. Insurance product guarantees are backed by the financial strength and claims-paying

ability of the issuing company.