Moore Financial Solutions 4th Quarter 2025

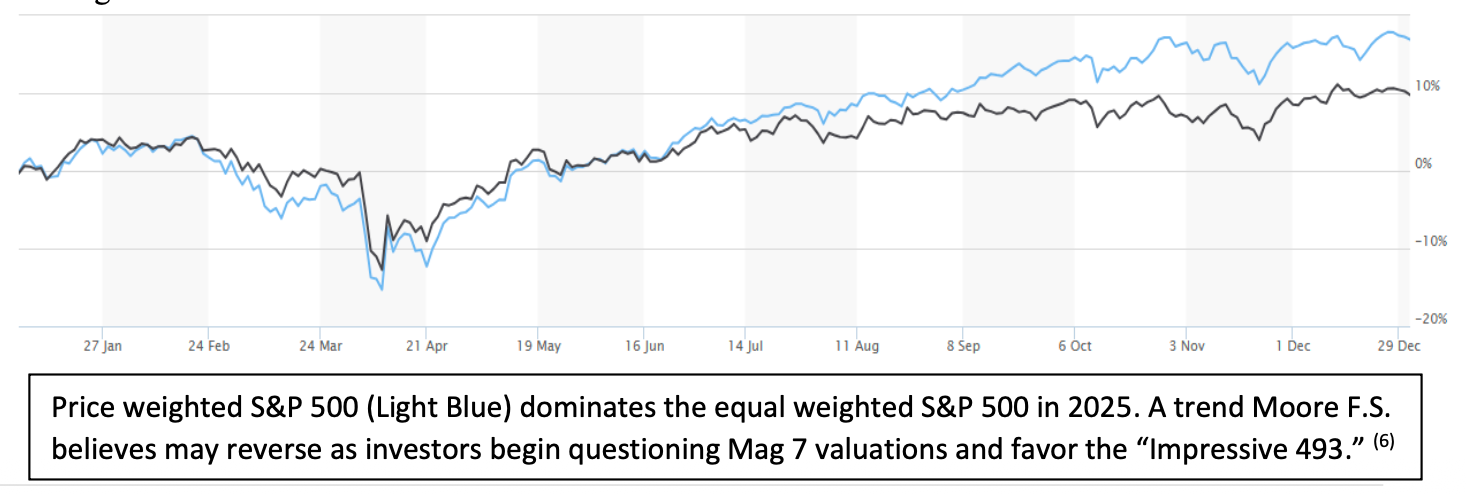

As 2025 ends, we joyfully review another positive quarter for the S&P 500, with it logging about a 2.3% gain, plus dividends (1). Much like a banked 3-pointer in a game of basketball, we won’t complain about scoring points, even though it may not have looked pretty, with extreme volatility near April (and again seven companies creating a large portion of gains.) Realistically, the annual return of 16.39% on the S&P 500 for the year is great, especially when it follows 24% and 23% returns the prior two years (2).However, we take exception to the continual heavy lifting done by the “Mag 7” (Google/Alphabet, Nvidia, Microsoft, Tesla, Meta/Facebook, Apple, and Amazon) as they now make up nearly 35% of the S&P 500. The other 493 stocks making up the S&P 500 represent the other approximately 65% of the index and only returned approximately 10% for the year. I will discuss much more on this and how Moore F.S. has attempted to mitigate some of this Mag 7 risk. Additionally, we’ll discuss interest rate movements along the yield curve, the Federal Reserve, and share our most recent trade and strategy for 2026.

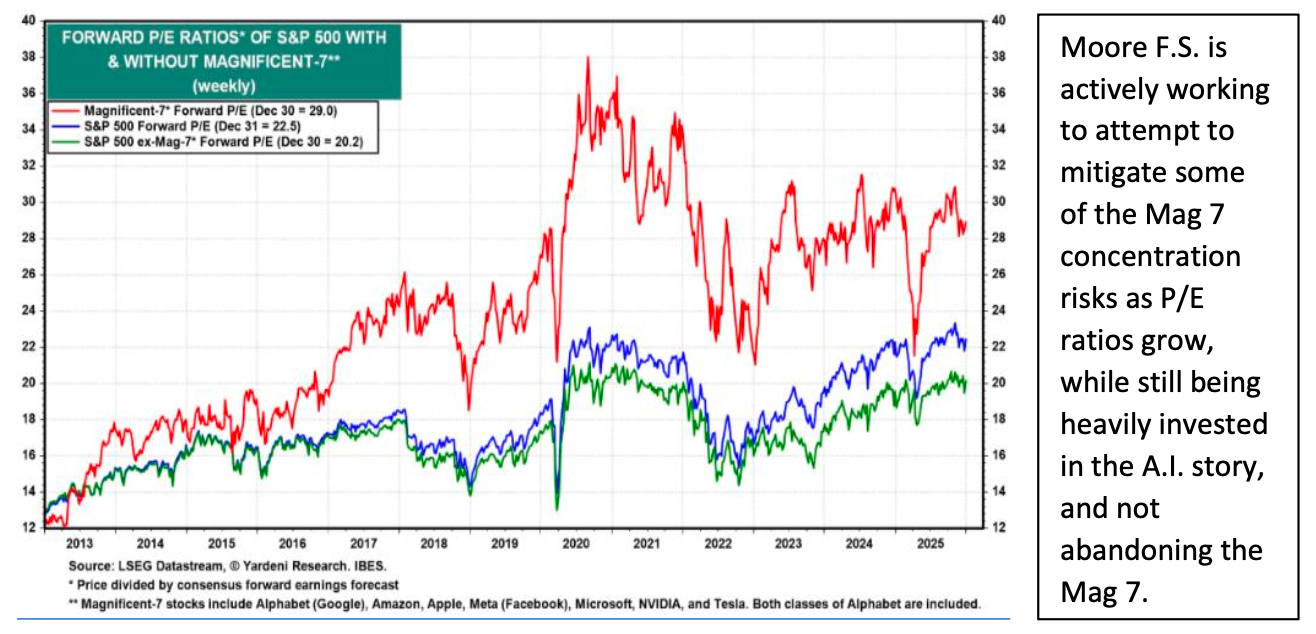

More than likely “Mag 7” is a phrase you’ve heard of. Naturally, some of you have not heard of the financial term Mag 7, so perhaps the only thing coming to mind is the 1960 movie The Magnificent Seven. In today’s world Mag 7, as mentioned above, refers to some of our largest publicly traded companies in the United States. Not by coincidence, each of these companies are all using Artificial Intelligence (A.I.) in some way. This ranges from Microsoft being extremely involved, Nvidia the A.I. hardware backbone, to Tesla using moderate adoption for self-driving. Our view is that the recent run up in big tech likely is merited, with J.P. Morgan recently offering, “the advent of generative AI is a seminal moment in tech, more so than the Internet or the iPhone (3).” With some offering such a bullish viewpoint on the Mag 7 we do not fear investing in it for the appropriate client. But, with the Mag 7 having about a 29 price to earnings ratio (read MFS Q1 ’24 review to learn more about how we use P/E ratios) and the other 493 stocks that make up the index having a P/E ratio of only about 20, we believe the time has come to reduce our exposure to Mag 7 holdings. We consider it our foremost goal to balance risk. By taking a risk/reward analysis approach, we believe the value is in the 493, but we are not abandoning the Mag 7 holdings.

In the last couple of weeks of 2025, we moved approximately 10% of all IVV holdings to RSP. We believe this trim of the iShares Core S&P 500 ETF and move to the Invesco S&P 500 Equal Weight ETF is a march towards better valuations. Additionally, many of Wall Street’s brightest are questioning Mag 7 valuations. Ed Yardeni of Yardeni Research is now shifting his stance on the group, which includes the "Magnificent Seven" stocks, to a more neutral position. Instead, Yardeni is more bullish on the rest of the S&P 500, which he has labeled the "Impressive 493." He continues, "I'm kind of betting ... that all companies are becoming technology companies," Yardeni told CNBC in December. "You either make it, or you use it, and I think more and more companies are using technology to increase productivity (7)"

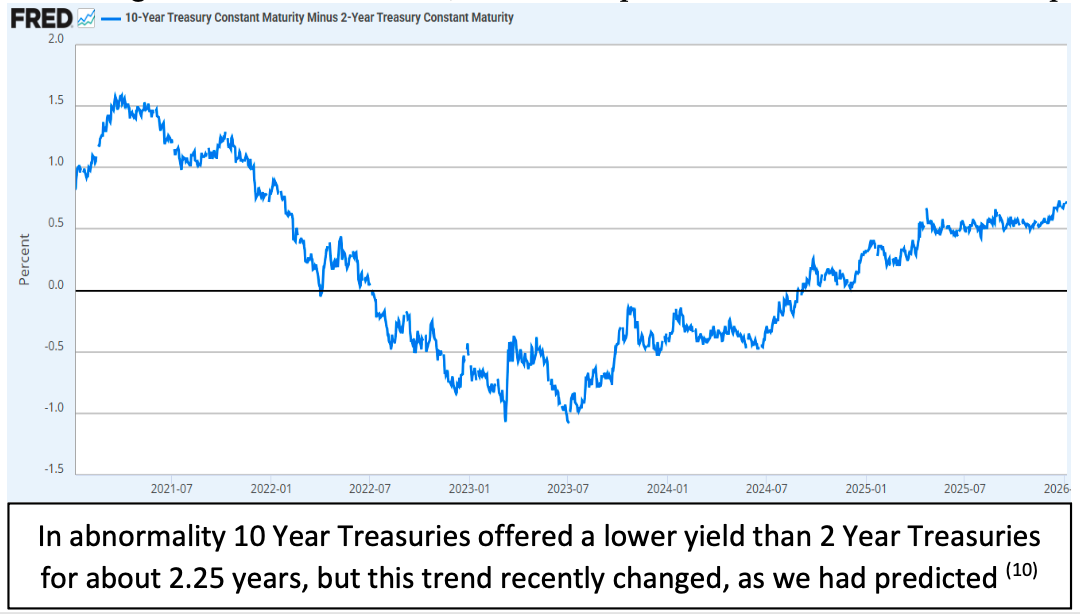

In the Moore F.S. Q3 2024 review we offered actionable advice to all readers to purchase (if appropriate) Goldman Sachs (ticker symbol GS) shortly after we added it to nearly every portfolio at about $487/share. To close the year, the 10 Year U.S. Treasury offered about .681% higher yield than the 2 Year U.S. Treasury yield (8). Following closely as predicted, Goldman Sachs closed the year at $878.77/share, likely with room to run higher this year, in the opinion of Moore F.S. (9). As discussed in that previous quarterly review, we anticipate interest rates will continue to fall in 2026, as President Trump has publicly disagreed with current Federal Reserve Chair Jerome Powell’s pace of interest rate decreases, citing a weakening labor market. However, with A.I. implementation on the rise we anticipate a further continuing of weakening in the labor market. With Jerome Powell’s term scheduled to end in May 2026, Wall Street tries to predict the next Fed Chair as most offer Kevin Hasset as the frontrunner. Currently, Mr. Hassett is the director of the National Economic Council and in the first Trump administration he was a senior advisor and chairman of the Council of Economic Advisors (11). With predictions markets stating a 70% chance for Mr. Hasset to be the next Fed Chair, there seems to be no confusion on the direction he would move rates as he recently offered, “if you look at central banks around the world, the U.S. is way behind the curve in terms of lowering rates.” As a result, we believe small Cap stock indexes have a strong opportunity to outperform large Cap indexes such as the S&P 500.

I approach 2026 with caution after the last three years in the S&P 500 returned approximately 24%, 23%, and 17% (12). Though it would be hard to forecast a fourth straight double-digit year, it is possible as investors look to A.I. to drive companies’ earnings higher. Be prepared that a fourth straight double-digit year historically would be challenging, but historically, A.I. was not a driving force to stocks moving higher, like it is today. It is a tough balance to ensure clients have a good risk/reward ratio and are receiving the rate of return they deserve. Many clients cannot afford to be overly conservative in only bonds or use an annuity for “protection” so we must be willing to be allocated to stocks as appropriate for each client and trust the process. With recent action to move away slightly from the Mag 7 holdings, it does feel strange to move away from what has worked so well. However, it seems undebatable that Mag 7 expectations are sky high. As always, I manage each account individually to your situation and rely on you to trust the process. I want to wish you and your family a happy new year and remind you that I’m only a phone call away if you have any questions. It is with great pride to act as your trusted advisor.

Did you know? Moore Financial Solutions offers unique/custom-built insurance solutions. Does anything keep you up at night that we could help fix? If so give us a call and we’ll help find you the best policy rates and options as we shop the open market of providers, all while offering our zero-pressure sales process. This includes Life Insurance, Disability Income Insurance, and Long-Term Care Insurance. Let’s review your policy and search for Moore Solutions today!

1. https://finance.yahoo.com/quote/%5EGSPC/history/

2. https://www.macrotrends.net/2526/sp-500-historical-annual-returns

3. https://www.northernlight.com/blog/will-generative-ai-be-bigger-than-the-internet#

4. https://finance.yahoo.com/news/ed-yardeni-steps-back-magnificent-175700637.html

5. https://www.marketwatch.com/investing/fund/mags

6. https://www.marketwatch.com/investing/index/spx/charts?mod=mw_quote_advanced

7. https://finance.yahoo.com/news/ed-yardeni-steps-back-magnificent-175700637.html

8. https://www.cnbc.com/quotes/10Y2YS

9. https://www.marketwatch.com/investing/stock/gs

10. https://fred.stlouisfed.org/series/T10Y2Y

11. https://www.foxbusiness.com/economy/trump-narrows-fed-chair-picks-january-decision-expected

12. https://www.marketwatch.com/investing/index/spx?mod=home_markets

This material has been prepared for information and educational purposes and should not be construed as a solicitation for the purchase or sale of any investment. The content is developed from sources believed to be reliable. This information is not intended to be investment, legal or tax advice. Investing involves risk, including the loss of principal. No investment strategy can guarantee a profit or protect against loss in a

period of declining values. Past performance may not be used to predict future results. Investment advisory services offered by duly registered

individuals on behalf of CreativeOne Wealth, LLC a Registered Investment Adviser. CreativeOne Wealth, LLC and Moore Financial Solutions

are unaffiliated entities. Licensed Insurance Professional. Insurance product guarantees are backed by the financial strength and claims-paying

ability of the issuing company.