Moore Financial Solutions Fourth Quarter 2023

The time is finally here, your patience and discipline to hold tight in tough market cycles has been

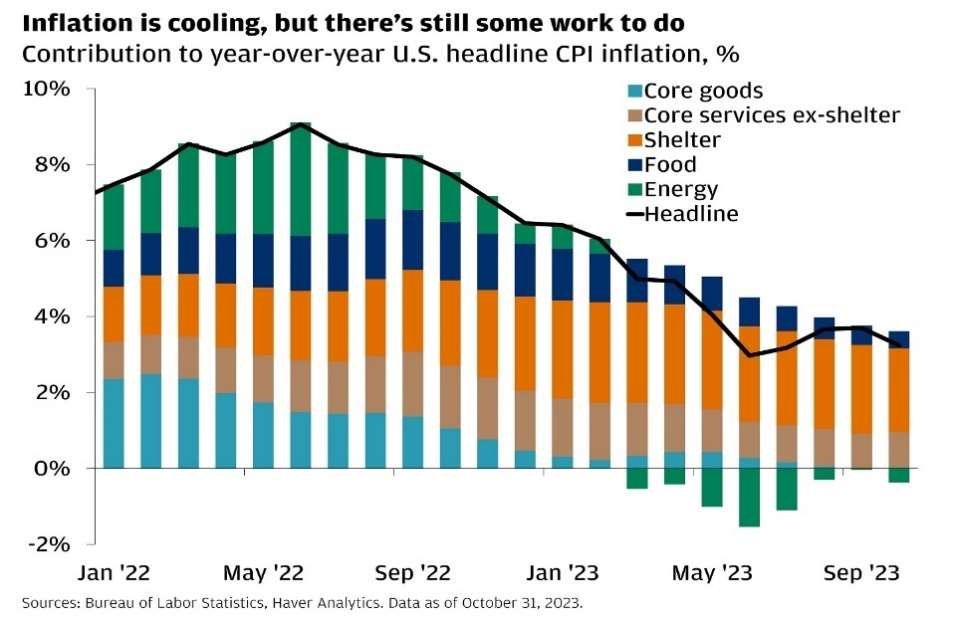

rewarded. The S&P 500 has made a Q4 2023 increase of 11.24%. This upward move in the S&P 500 from 4,288.05 to 4,769.83, was driven mainly by a significant decrease in interest rates (1). As we discussed in our Q2 2022 review, clients were asking, “when will the pain end and what will make it end?” Our answer at the time was, “In our opinion, if inflation readings can begin to show that Federal Reserve policy is having the desired effect, markets will begin to recover.” In December, Moore Financial Solutions investors celebrated news that the Federal Reserve’s primary inflation reading, the core PCE price index, created optimism that inflation had cooled. This measure showed only a 1.9% annualized rate for the past six months, based on Commerce Department data (2).

Though too soon to declare victory, investors drove the 10-year U.S. treasury interest rate in Q4 down from 4.579% to 3.881%, forecasting the Federal Reserve would trade in their “hawkish” views of 2023 for a more “dovish” outlook. This decrease in interest rates was great news to stock investors, especially considering this same benchmark saw rates over 5% in Q4 (3). Additionally, the S&P 500 added 24.23% for the year, which we hope provides confidence to investors that markets have historically recovered after a downturn (4). We hope you can reflect on this as an example of Moore F.S. keeping you grounded in your long-term plan while the media could have scared you out of equities.

Since the Federal Reserve began tightening monetary policy in response to elevated inflation readings, many feared a looming recession. Though this recession has not arrived, many still believe there is potential it still could. Moore F.S. has remained committed in our belief that the Federal Reserve can thread the needle and guide the U.S. economy into a “soft-landing” and avoid a deep recession. In early 2023, many investment firms were becoming nervous of their allocations to stocks and were commonly encouraging investors to trim positions in stocks and brace for a downturn. There was no shortage of “bears” on Wall Street assuming the market would fall in early 2023. JP Morgan was forecasting that the market would "re-test" the lows of 2022 in the first half of 2023, meaning the S&P 500 would decrease back near the October 12, 2022 closing price of 3,577.03 (5).

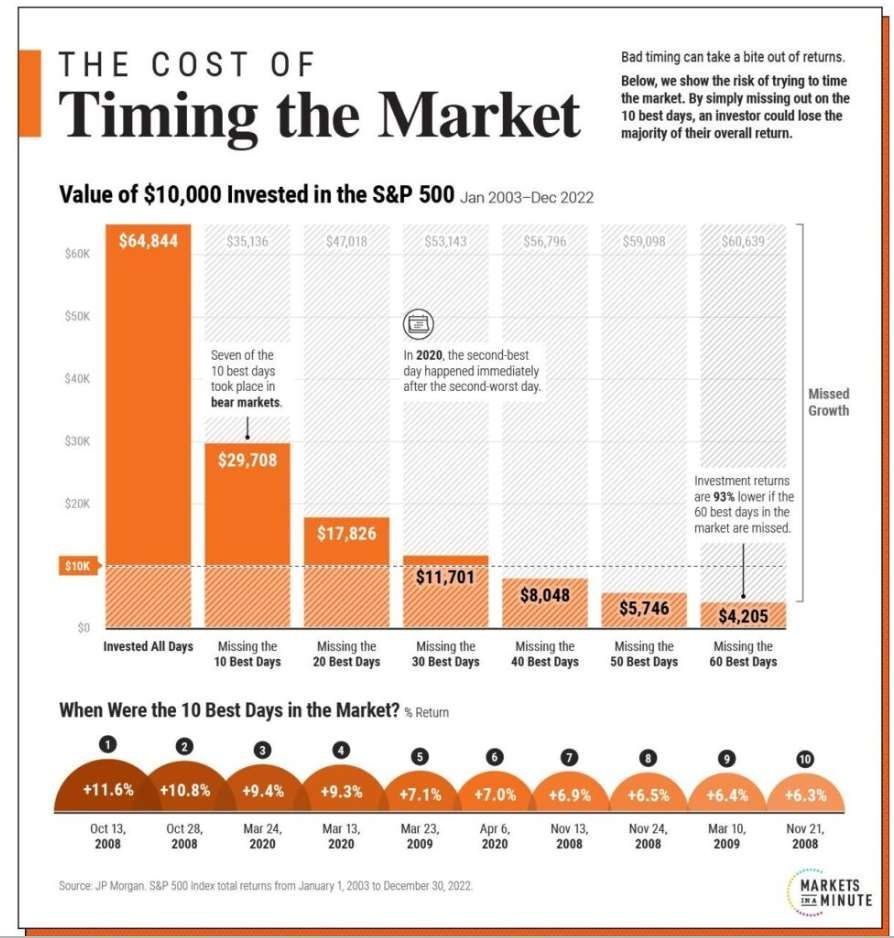

When helping clients through all market cycles we’ve developed the opinion that financial advisory has two major components. The first is having the right type of accounts. Most clients have a pre-tax employer sponsored account that will become a Moore F.S. Traditional IRA when they change jobs, attain the age of 59.5, or retire. We often encourage setting up post-tax accounts such as a Roth IRA as well. Moore F.S. will fine tune the ratios of various account types and determine if an IRA conversion makes sense. The second component is having the proper investments within your account. We favor more risk/potential reward within post-tax accounts and using them in the back half of retirement to give them the longest growth period. Regarding the investment allocation component, we feel strongly that this responsibility is best left to a fiduciary, and not simply a financial professional or insurance agent. As your fiduciary, we allocate your investments to your best interest. During volatile moments we stay grounded in our plan, and do not make emotional decisions that might reduce your growth. As our clients have called with thoughts of moving to money markets to avoid volatility, our focus was on the recovery of equities. Many investors become nervous when the market drops, despite this being the best time to be in the market, assuming a recovery will occur soon. In fact, many of the strongest days occur just after down periods, as disciplined investors take advantage of better buying opportunities in the market. With Moore F.S. you can rest assured that we will not panic and sell your equities in down market cycles. Moore F.S. generally will stay fully invested even in down periods to avoid mistakes commonly made by non-fiduciary agents or personal investors. Historically, missing the best days of the market can compound into major missed opportunities (6).

Looking forward to 2024, we feel strongly optimistic that the markets will continue their rally. Though past performance does not guarantee the future, we draw our conclusions from the stock market’s history. Following a 20% or greater move in stocks, the market was up 22 of 34 of the following years, equating in a positive stock market return the following year occurring 65% of the time (7). Since 1952, the S&P 500 has averaged a 7% gain during U.S. presidential election years (8). Since the creation of the S&P 500 there have been 23 election years, with a positive stock market performance year occurring in 19 of these periods, or 83% of the time (9). When a Democrat was in office and a new Democrat was elected, the total return for the year averaged 11.0%, and When a Democrat was in office and a Republican was elected, the total return for the year averaged 12.9% (10). As President Biden ends 2023 with a 39% approval rating, we view the chances of a change in presidency as slightly more probable than no change (11). Additionally, the labor market has been resilient and able to shake off interest rate increases. We believe a strong labor market coupled with lower energy prices (compared to a year ago) and falling interest rates create a high probability of further stock market increases. We feel as if the Securities and Exchange Commission will approve a Bitcoin exchange traded fund in the first half of 2024. As a result, we plan to include a 2-4% allocation to an iShares Bitcoin ETF sponsored by Blackrock.

Whether I’ve been your fiduciary for 10 years or 10 days, my goal is to provide you comfort in knowing that your and my goals are identically aligned. As I’ve said in the past, the down markets are just as hard on me as they are you. I’m a client of my own firm with investments rooted in the same stock market as you. In my opinion, without the market, you’ll be too conservative and must work a decade longer. With using the wrong advisor (or no advisor) you’ll be left wondering if your plan is adequate and tempted to make emotional decisions. With me coaching you to emotionally be ok with volatility and investing primarily in assets that have historically recovered after downturns, together we make a strong team. As the calendar turns to 2024, please keep in mind those that deserve to work with me as their fiduciary and refer them to me as needed. My goal remains to operate a cutting-edge platform with a small-town feel. I want to wish you and your family a great start to 2024 and empower you to set and reach your goals! As a reminder I’m only a phone call away if you need anything.

Tyler A. Moore

913-731-9105

“You expect good things from the New Year, you expect hope, but the New Year also has something to tell you: You create both the good things and the hope yourself, so don't expect anything, do it yourself, create it yourself, don't wait!” - Mehmet Murat Ildan

- https://finance.yahoo.com/quote/%5EGSPC/history/

- https://www.investors.com/news/economy/federal-reserve-key-inflation-rate-just-hit-2-percent-sp-500-rallies-as-rate-cut-odds-grow/#:~:text=The%20Federal%20Reserve%27s%20primary %20inflation,more%20than%20expected%20in%20November.

- https://www.marketwatch.com/investing/bond/tmubmusd10y?countrycode=bx&mod=home-page

- https://finance.yahoo.com/quote/%5EGSPC/history/

- https://finance.yahoo.com/news/jpmorgan-best-performing-15-stock-195504183.html#:~:text=Commenting%20on%20the%20stock%20market,Fed%20overtightens%20into%20weaker%20fundamentals.

- https://www.advisorperspectives.com/commentaries/2023/09/06/10-best-days-meme-bull-market-lance-roberts#:~:text=Over%20an%20investing%20period%20of,to%20long%2Dterm%20investment%20success.

- https://awealthofcommonsense.com/2023/12/what-happens-after-a-20-up-year-in-the-stock-market/#:~:text=The%20stock%20market%20was%20up,%2B18.8%25%20in%20up%20years.

- https://money.usnews.com/investing/articles/election-2024-how-stocks-perform-in-election-years

- https://advisor.morganstanley.com/the-ernie-garcia-group/documents/field/e/er/ernie-garcia-group/S%26P%20500%20in%20Presidential%20Election%20years.pdf

- https://advisor.morganstanley.com/the-ernie-garcia-group/documents/field/e/er/ernie-garcia-group/S%26P%20500%20in%20Presidential%20Election%20years.pdf

- https://news.gallup.com/poll/547763/biden-ends-2023-job-approval.aspx

This material has been prepared for information and educational purposes and should not be construed as a solicitation for the purchase or sell of any investment. The content is developed from sources believed to be reliable. This information is not intended to be investment, legal or tax advice. Investing involves risk, including the loss of principal. No investment strategy can guarantee a profit or protect against loss in a period of declining values. Investment advisory services offered by duly registered individuals on behalf of CreativeOne Wealth, LLC a Registered Investment Adviser. CreativeOne Wealth, LLC and Moore Financial Solutions are unaffiliated entities.